On August 16th, Avanci, a well-known platform for patent licensing, made a significant announcement on its official website – the launch of its 5G connected vehicle licensing project. This ambitious endeavor encompasses crucial 5G multi-mode essential standard patents and cutting-edge cellular vehicle-to-everything (C-V2X) technology. The eye-catching detail that sparked widespread interest and heated discussions was the pricing strategy: Avanci introduced a base licensing fee of $32 per vehicle.

To provide context, this pricing represents a substantial increase when compared to Avanci's earlier 4G licensing project. In 2017, they initiated their 4G project with a rate of $15 per vehicle, accompanied by a promise of no price hikes. However, market dynamics or disagreements among stakeholders led to a revision in July 2022, increasing the rate to $20 per vehicle. This experience likely emboldened Avanci to propose higher pricing for the 5G project. Importantly, this time, Avanci included a statement indicating that "the above pricing may change in the future," allowing for potential adjustments tied to industry growth or increased participation.

Now, let's delve into the analysis of Avanci's 5G project pricing logic, considering two hypotheses:

Pricing Logic Hypothesis 1: Comparison with 4G Project Licensing Rates

To understand the pricing logic behind Avanci's 5G project licensing fees, it's essential to consider Avanci's previous 4G project rates. In early 2017, Avanci set the price at $15 per vehicle and boldly promised no price increases. At that time, their internal economic modeling likely included room for additional SEP rights holders to join beyond the initial licensors. However, factors such as exceeding the initial predictions for licensors joining the project, significant disagreements among rights holders joining the project, or Avanci's confidence in achieving higher licensing revenue from the successful market adoption of the 4G licensing project could have contributed to the decision to raise the 4G project's rate to $20 per vehicle in July 2022. The market success of the 4G project gave Avanci the confidence to propose higher pricing for the 5G project, and the experience of altering the pricing mid-course in the 4G project served as a lesson to refrain from making pricing commitments this time.

Around July 2022, the total number of licensors participating in the Avanci 4G project was approximately 40. In addition to initial licensors such as Ericsson, Qualcomm, Interdigital, KPN, and ZTE, several SEP holders in the 4G domain joined over time, such as Nokia (October 2018), NTT Docomo (October 2018), Datang Telecom (July 2019), and LG (February 2022). Considering the timeline of licensors' participation and their share of essential 4G standard patents in July 2022, it can be estimated that licensors participating in the Avanci 4G licensing project accounted for approximately 57.66%[1] of the total essential 4G standard patents. Based on a top-down approach, it can be inferred that the total licensing fee stack for all communication essential patents related to connected vehicles should remain within $35 per vehicle.

In the case of Avanci's 5G licensing project, 58 licensors have joined. Calculating their cumulative share of 5G essential standard patents indicates a level of 87.82%[2]. Assuming that the sum of licensing fees between 4G and 5G communication standards will not change significantly[3], it appears that licensors in Avanci's 5G project can receive approximately $30.73 per car based on an essential patent share of 87.82%. This closely aligns with the currently announced rate of $32 per car and the early bird rate of $29 per car, with an average of $30.5 per car.

Pricing Logic Hypothesis 2: Valuing Communication Technology in Connected vehicles

Avanci's charging model for automakers in the context of connected vehicles has long been criticized by the automotive industry due to significant disparities between vehicle prices and TCU (Telematics Control Unit) prices, with differences exceeding 350 times. The price gap with baseband processor prices, which provide communication functionality, is even more significant, with differences of up to 1750 times. Such significant price differentials inevitably lead to substantial differences in expected licensing fees, leading to disputes, whether concerning the level of charges (License to all or Access to all) or the definition of the smallest salable patent practicing unit (SSPPU).

To bridge these gaps and avoid disputes, Avanci appears to have attempted a different approach to justify its pricing. "Avanci's licensing program offers an efficient and economical choice for companies needing access to cellular communication technology essential patents. We base our licensing fees on the value that technology brings to vehicles, not the price of vehicles,"[4] states Avanci. By choosing the value brought to vehicles by communication technology as the basis for licensing fee pricing, Avanci avoids the controversy surrounding the vehicle's price as a basis and instead employs the relatively vague concept of the value communication technology brings to vehicles. This approach not only bypasses the basis controversy related to vehicle prices but also aligns with one of the foundational principles of the patent protection system, the principle of proportionality. However, the key question is how to determine the value that communication technology brings to vehicles and who determines it?

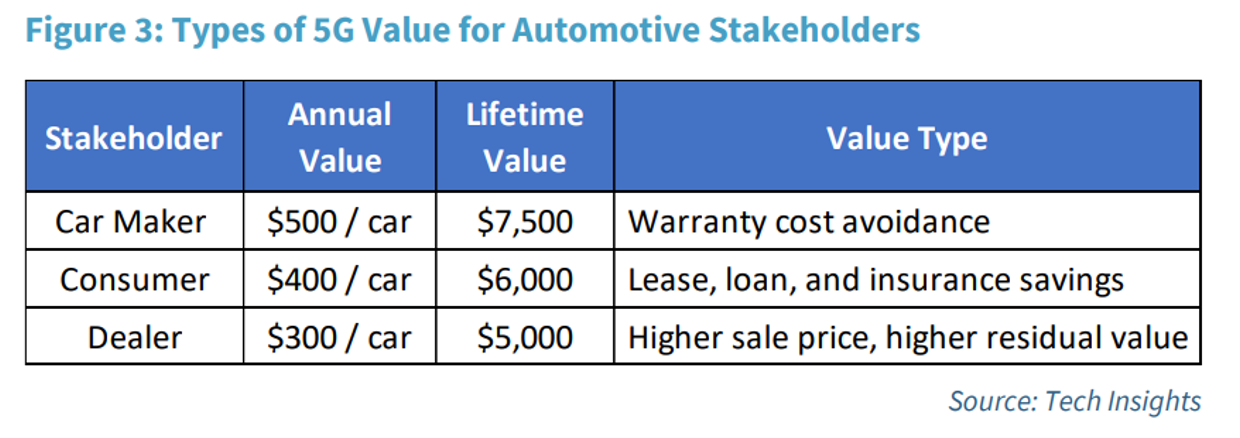

To address this, Avanci commissioned Tech Insights to write a report titled "5G Connected vehicles: A Revolutionary Value Proposition," which was released on the Avanci website alongside the 5G connected vehicle licensing project. Clearly, the report aims to provide professional endorsement from an authoritative organization for the 5G licensing project. The report states that the total value of 5G communication technology to automobile manufacturers is $7500 per car. However, it does not provide specific value calculation methods and data sources, raising doubts about its fairness and validity. According to this contribution value, it seems that there is still ample room for future rate increases under the current 5G project.

In an earlier report in 2020, Dr. Bowman Heide from 4iP Council titled "The Value of Connectivity in the Automotive Sector" provided a more detailed data model and data on the value of connectivity in the automotive ecosystem. From the perspective of automotive manufacturers' lifecycle earnings (approximately $670 in the U.S. and an average of $593 worldwide), assuming the data is reliable, the current licensing rate for Avanci's 5G project is approximately 5.4%.

Another earlier study from 2016 by Simon Kucher & Partners[5] suggested, "German consumers are willing to pay an average of €440 for connectivity in a new car. American consumers are willing to pay more, just over $1000." If we consider this research data, it appears that cars with communication functionality can be sold for $480 to $1000 more than those without, and the price difference is understood as the value that communication technology brings to vehicles. In this case, the current licensing rate for the 5G project would be approximately 3.2% to 6.7%.

Conclusion

In conclusion, while referencing the pricing of Avanci's 4G project can help understand the pricing logic of the Avanci 5G project, it may not fully explain the fairness of the pricing of the Avanci 5G project itself.

Although related research reports provide a baseline for analyzing licensing rates in the connected vehicle industry, they allow us to explore the contribution ratio of communication functionality to the value-added part of the automotive industry within this framework. However, these reports may need more credibility due to the potential bias from commissions from interested parties. The investigation may not reflect the most recent findings and needs to be more comprehensive to assess the current global situation of intelligent automotive development. Additionally, the absence of investigative institutions in the Chinese automotive industry and the lack of data from Chinese automotive manufacturers and consumers are significant areas for improvement.

Author: Wen Ming

Wen Ming currently holds the position of Vice President at Purplevine Intellectual Property Group, where he oversees domestic litigation dispute resolution, transaction operations, and more. He is qualified as both a Chinese lawyer and a Chinese patent agent and excels in areas such as corporate intellectual property strategy, patent litigation, invalidation cases, and intellectual property operation and transactions. Before joining Purplevine, Wen Ming previously worked at ZTE Corporation.

References

[1] This calculation is based on data analysis of the proportion of 4G essential standard patents conducted by Iplytics. It's worth noting that this is a simplified model and doesn't take into account potential inaccuracies in Iplytics' data determination and statistics. It also doesn't consider whether licensors who joined the Avanci project retained some 4G essential standard patents without adding them to the patent pool.

[2] Using a similar approach to the one applied for 4G essential standard patents, this calculation doesn't factor in potential inaccuracies in Iplytics' data determination and statistics. It also doesn't consider whether licensors who joined the Avanci project retained some 5G essential standard patents without adding them to the patent pool.

[3] Referring back to [1], Qualcomm's actual licensing rate for 4G multi-mode products and the publicly disclosed 5G licensing rate are both 3.25%. Huawei charges a licensing fee of 1.5 yuan per unit for 4G and 2.5 yuan per unit for 5G. Taking into account Huawei's increased share of essential standard patents in 5G, which is more than 50%, and the higher average selling price (ASP) of 5G phones compared to 4G phones, this further supports the likelihood of the assumptions mentioned earlier.

[4] "Intellectual Property and Finance Exclusive Interview with Avanci: Why a 33.3% Increase in 4G Licensing Fees? How Will 5G Licensing be Priced?" (Chinese source) – Link

[5] "The Value of Mobile Connectivity in the Automotive Sector," 2016